Rhode Island Energy said it will not enter a power purchase agreement for the proposed Revolution Wind 2 project because the projected costs to electric customers are too high.

The decision is a setback for offshore wind developers Ørsted and Eversource – coming just after the federal Bureau of Ocean Energy Management announced it had completed an environmental review for the partners’ first-phase Revolution Wind project.

The Revolution Wind 2 decision, announced Tuesday by Dave Bonenberger, president of Rhode Island Energy, stated that “affordability and reliability would be key factors in how the company evaluated” offshore wind bids.

“Higher interest rates, increased costs of capital and supply chain expenses, as well as the uncertainty of federal tax credits, all likely contributed to higher proposed contract costs,” according to the company. “Those costs were ultimately deemed too expensive for customers to bear and did not align with existing offshore wind PPAs (power purchase agreements).”

The decision adds to the offshore wind industry’s troubles from rising costs, which already have developers looking to cancel contracts for two projects off Massachusetts and re-bid them in 2024.

In New Jersey, state legislators approved a last-minute budget vote that will allow Ørsted to use federal renewable energy tax credits for its Ocean Wind 1 project – instead of redirecting credits to lower customers’ bills – in a bid by Gov. Phil Murphy’s administration to keep the flagship project viable.

The Revolution 2 proposal was the only bid received by Rhode Island Energy in response to its Request for Proposals (RFP) in October 2022 for an additional 600 to 1,000 megawatts of offshore wind capacity.

The utility says its rejection decision “comes after a thorough, four-month evaluation of the bid, which was completed in consultation with the Rhode Island Office of Energy Resources and the Division of Public Utilities and Carriers. Rhode Island Energy said the proposal did not meet all the requirements as detailed in the Affordable Clean Energy Security Act.

“In the next 60 days, the company will provide a comprehensive filing with the Rhode Island Public Utilities Commission detailing its decision. It will provide elements of why the proposal did not meet the ACES requirement “to reduce energy costs” and other factors that scored low in the evaluation. OER and the Division will also file comments, and the bidders will also have an opportunity to respond to those findings.”

“We recognize some will be disappointed that we didn’t choose to move forward on negotiating this PPA, but that doesn’t mean we are abandoning our commitment to offshore wind in Rhode Island,” said Bonenberger of Rhode Island Energy. “In fact, we are already in discussions with state and regional leaders about new opportunities to bring more offshore wind to the state, which we hope to progress in the coming months.”

Meanwhile Rhode Island Energy is working on transmission line upgrades to support Ørsted and Eversource’s original Revolution Wind project, expected to be operational in 2025.

BOEM on Monday announced its environmental analysis for Revolution Wind would be published July 21, with expectations that the agency will make a final decision on the developers’ construction and operations plan this summer.

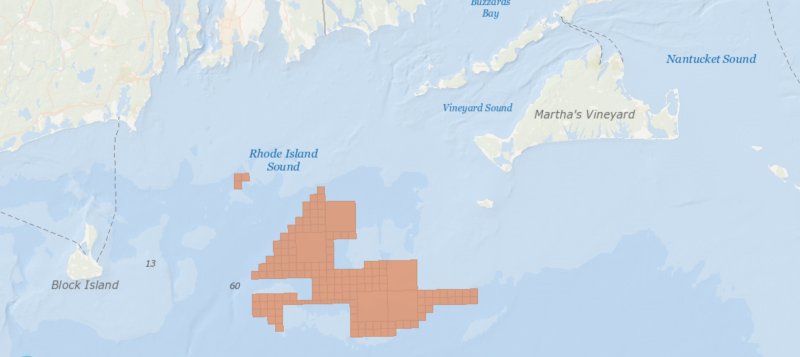

The EIS documents refer to Alternative G as the agency’s “preferred alternative,” which could rearrange wind turbine locations on the lease tract “to reduce impacts to visual resources and benthic habitat.”

The alternative includes up to 79 possible positions for the installation of 65 turbines of 8 to 12 MW ratings, enough to fulfill the project’s designed total nameplate rating of 704 MW within a 1-nautical mile grid spacing.

“This flexibility in design could allow for further refinement for visual resources impact reduction on Martha’s Vineyard and Rhode Island, or for habitat impact reduction in the NMFS Priority 1 area,” according to the report.

The analysis foresees “long term moderate to major adverse depending on the fishery and fishing operation. If BOEM’s recommendations related to project siting, design, navigation, access, safety measures, and financial compensation are implemented across all offshore wind energy projects, adverse impacts on commercial fisheries due to the presence of structures could be reduced.”

At local fishing ports, the largest impacts in terms of “exposed revenue as a percentage of total commercial fishing revenue” would be in Little Compton (6.4%), Westport (5.1%), and Chilmark/Menemsha (3.6%), according to the report.

The National Marine Fisheries Service conducts eight annual surveys that cover the Revolution Wind area, and the developers will be required to submit a draft survey mitigation agreement with NMFS to address future data gaps on bottom trawl surveys, shellfish and marine mammal surveys.

“This measure, if adopted, would reduce uncertainty in scientific survey results, which would reduce uncertainty in stock assessments and quota setting processes,” the report states. This reduced uncertainty, in turn, would help avoid more conservative catch quotas and/or more restrictive effort management measures for commercial and recreational fisheries.”

Along with a “direct compensation fund” proposed by the Revolution Wind developers to make up for fishermen’s losses, BOEM would require extending that coverage to shoreside seafood support services. The developers will be required to analyze the impacts to shoreside seafood support services within the communities nearby ports” and “the shoreside seafood business analysis would be used to further supplement funds available for settling claims of lost (unrecovered) economic activity as a result of the project”.