Building on moves by Louisiana, offshore wind advocates see the Gulf of Mexico as a next major step for developing the U.S. industry – possibly including re-use of offshore oil and gas platforms and pipelines as assets for an allied “green hydrogen” industry.

“We know offshore wind takes a long time to get off the ground…we’ve got to move fast,” said Liz Burdock, president and CEO of the industry group Business Network for Offshore Wind, on the opening days of its International Partnering Forum conference in Richmond, Va.

BNOW’s Gulf of Mexico working group conferred by video Tuesday with officials in Louisiana Gov. John Bel Edwards’ administration and the federal Bureau of Ocean Energy Management, which has been working since June on Bel Edwards’ request to seek commercial interest in developing wind power off his state.

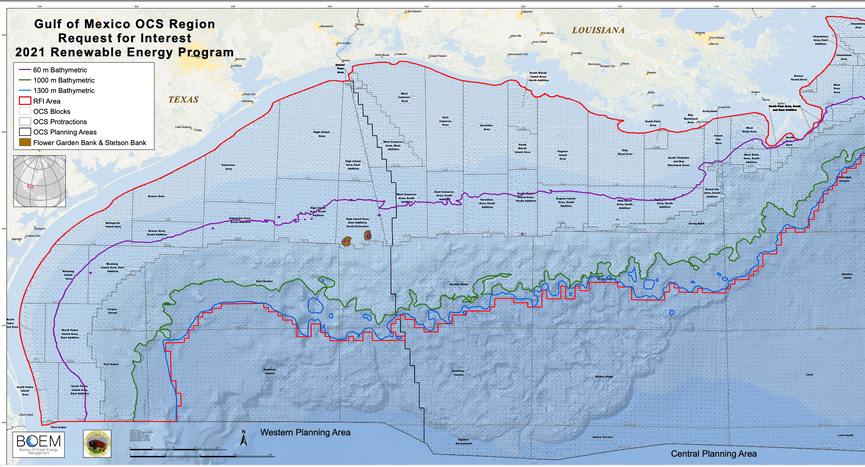

The agency is taking its early look at a swath of the gulf outer continental shelf out to 4,000-foot depth for potential siting of fixed-foundation and floating wind turbines.

“We are at the very beginning of that process,” said Tershara Matthews of BOEM. The agency is reviewing comments from stakeholders – along with some proprietary information offered by potential wind developers – to assess its next steps.

“There was interest in both fixed and floating,” added Mike Celata of BOEM, with more tending toward fixed development on the shallower shelf. Most of that is focused west of Lafayette, La., with “overlapping interest” by different developers, he said.

An early schedule by BOEM calls for possibly offering leases for bid in December 2022 but “it may slip…there is a lot of work to be done,” especially with talking to commercial fishing interests in the region to reduce potential conflicts, said Celta.

“It’s clearly something we have to do to have a successful auction in December 2022,” he said. Celata is scheduled to make a presentation Wednesday Aug. 25 at the Gulf of Mexico Fishery Management Council meeting.

The Bel Edwards administration and state resource agencies are already in such discussions with the shrimp industry, said Harry Vorhoff, who works on the governor’s energy policy.

Another emerging interest is potential re-use of older oil and gas platforms and pipelines for producing hydrogen fuel with wind power, said Joseph Orgeron, business and technology developer for 2nd Wind Marine LLC, Galliano, La.

“I really don’t want to hurt the December ’22 target date” for lease sales, Orgeron quipped, but hydrogen production could be an attractive path for future conversion of existing leases to renewable energy.

“The majority of the non-majors out of Houston have expressed interest,” Orgeron told the group and BOEM officials, although the companies have not gone public with that.

Louisiana Department of Natural Resources Director Jason Lanclos said state officials see huge opportunity for the state’s maritime and manufacturing industries with offshore wind, both on the East Coast and in the gulf.

The group discussed strategies for generating more enthusiasm in neighboring states as well.

“I think we’re suffering a little bit from the stigma of East Coast wind development with kicking the can down the road” with long reviews and delays, said consultant Doug Campbell of DRC Inc./Oil States, Houston.

The gulf states need to plan to add wind and renewables to their longtime offshore oil and gas portfolios, “so this human capital that’s in place” for offshore work can be used, said Rob Erikson of Bokalis Offshore Energy, Houston.