Combined coastwide catch for all users is down by nearly 16 percent, more than 18 percent for commercial fishermen.

The 2025 Pacific halibut fishery kicks off today, March 20, in regions spanning from the West Coast and British Columbia to the far reaches of Alaska's Bering Sea. And once again, all users - commercial fishermen, sport charters, anglers, and subsistence - will get smaller takes of the prized fish as the Pacific stock continues to flounder.

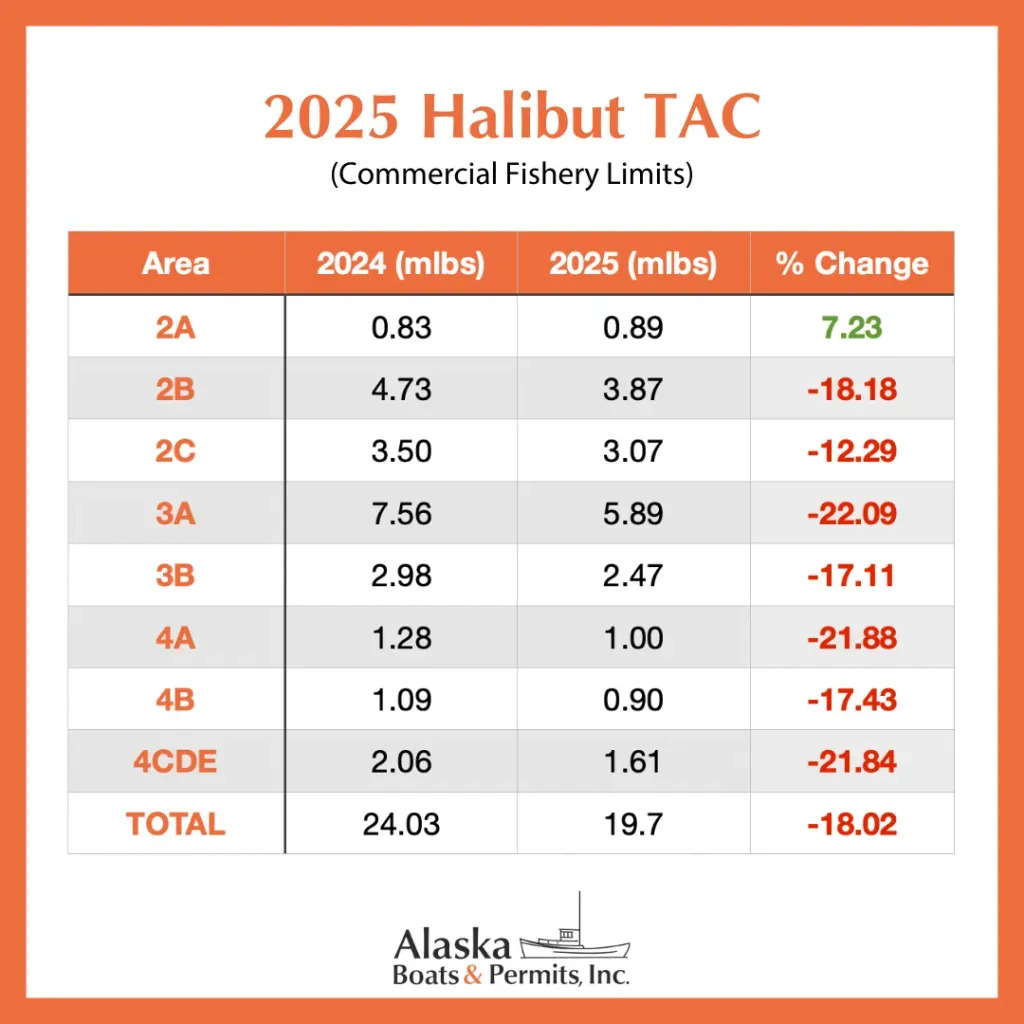

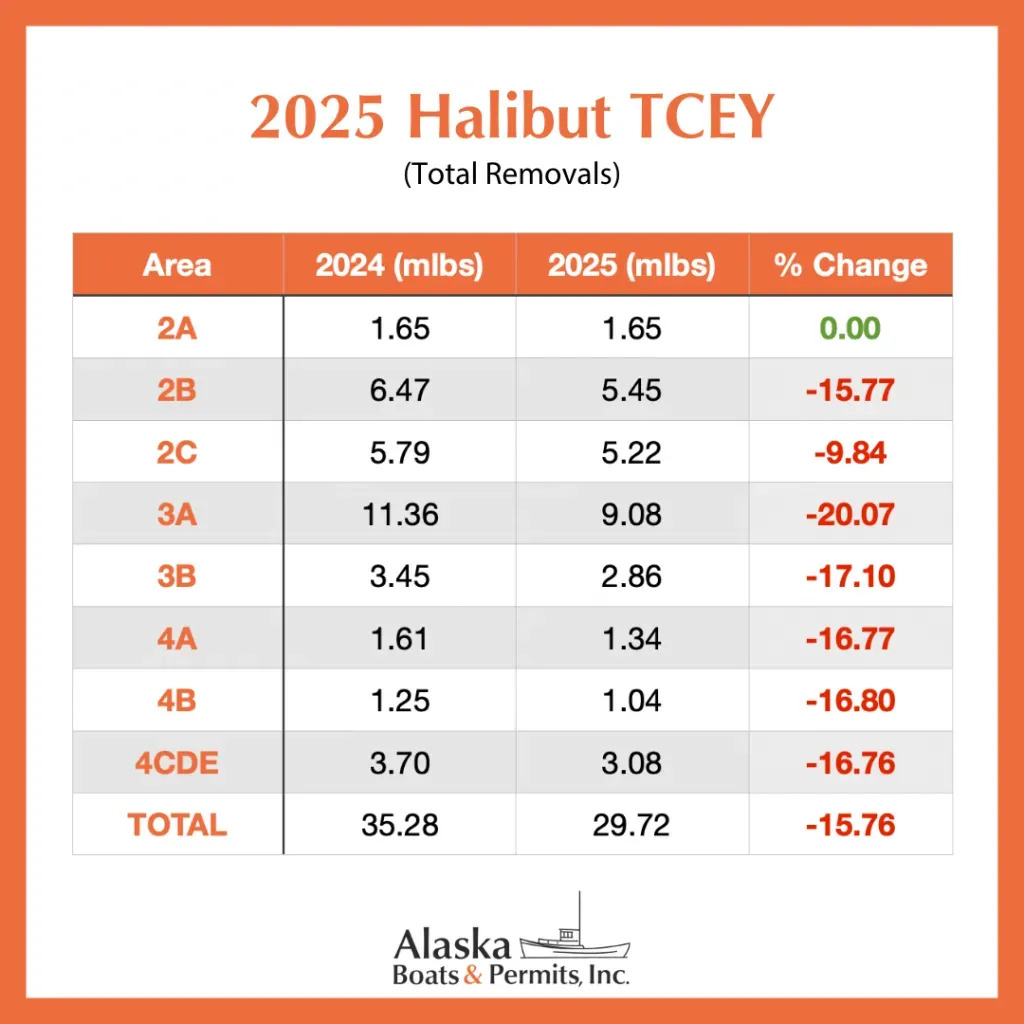

The coastwide "total removals" of halibut allowed for 2025 is 29.72 million pounds, a drop of 15.76 percent from 2024. For commercial fishermen, a catch limit of 19.7 million pounds is an 18.02 percent decrease from the 2024 fishery. Last year, harvesters took just over 74 percent of their 28.86 million pound commercial catch limit.

The catch limits are set each January by the International Pacific Halibut Commission (IPHC), which has tracked and managed the stock for 101 years.

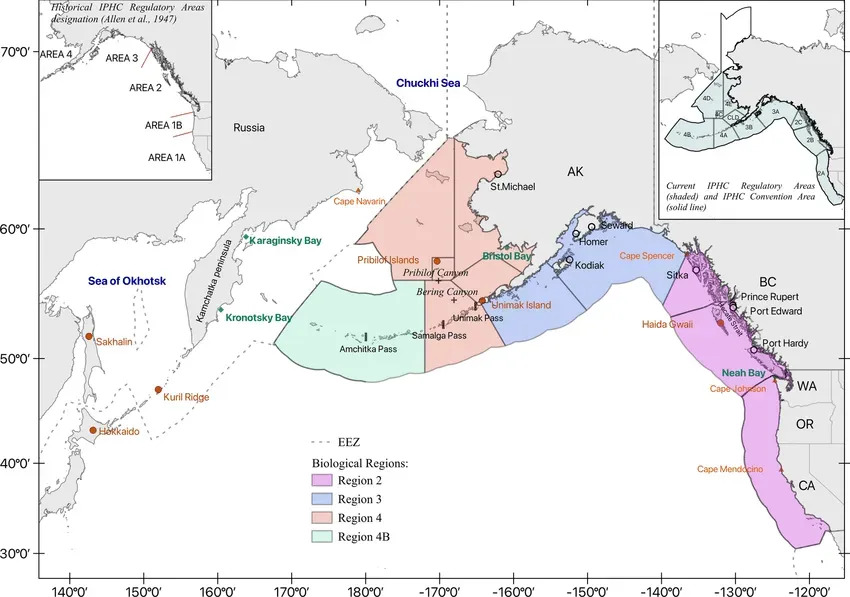

According to stock distribution reports by the IPHC, after increases in 2020-2021, the proportion of the halibut in Biological Region 3 (Central and Western Gulf of Alaska) decreased in 2022-24 to the lowest estimate ever. Interestingly, this trend occurred in tandem with increases in Biological Region 2 (from California to Southeast Alaska).

The report added that the directed coastwide commercial fishery catch rates in nearly all areas were at or near the lowest observed in the last 40 years. The absolute level of spawning biomass is also estimated to be near the lowest observed since the 1970s.

IPHC scientists said in January that the lack of survey sampling in Biological Region 4B (the Aleutian Islands and Bering Sea) “has resulted in increased uncertainty in both the trend and scale of the stock distribution in this region.”

The scientists concluded that “Environmental conditions continue to be unpredictable, with important deviations from historical patterns in both oceanographic and biological processes observed across the stock range in the last decade.”

Meanwhile, the IPHC is facing a funding crisis that might cause severe cutbacks in the annual halibut stock surveys.

Tariff disputes drive market uncertainty

In terms of markets, if projections are on target, the overall supply of Pacific halibut will be 5.5 million pounds less than last year's paltry commercial catch, which barely topped 21.34 million pounds.

On-going tariff disputes between the U.S. and Canada "will impact the processing and distribution of fresh and frozen halibut this year," predicts Rob Reierson, CEO of global trading company Tradex based in British Columbia. "It’s anyone’s guess where trade dynamics will settle," he added, "but tariffs would drive up costs, disrupt supply chains, and create price volatility."

Over the past five years, Canada has harvested an average of 5 million pounds of Pacific halibut annually, compared to 17.2 million pounds in the U.S., or roughly 22 percent and 78 percent of the total catch, respectively. The majority of the catch comes from Alaska, averaging 16.4 million pounds over that time frame. Halibut catches from Washington, Oregon, and California have averaged over 800,000 pounds.

Fresh halibut dominates the market for most of the season, Reierson said, and trade data show that in 2024, upwards of 4 million pounds of U.S. fresh halibut were shipped to Canada. "Just to complete the global picture, it’s estimated that Russia harvests about 4 million pounds of Pacific halibut annually," he added.

Reierson recommended that halibut buyers get busy lining up their fresh and frozen fish now. There will be less fish available overall, "and consumer demand for this premium product should remain constant even during economic changes," he said, adding: "If the catch ends up surpassing fresh demand, new season halibut will go to the freezers faster while pricing is sustained."

Dock prices for Alaska fishermen in 2024 fluctuated between over $5 per pound to over $7 all season.

The 2025 Pacific halibut fishery closes on December 7.