A new Seafood Database created by Planet Tracker identifies the companies most exposed to overfishing, illegal fishing and other sustainability risks across the $1.8 trillion seafood supply chain.

There is no Bloomberg terminal for ocean sustainability data, which is notoriously fragmented and hard to access. And yet, that data is a critical driver of the financial performance of ocean-dependent companies. The opening note from the briefing paper “No More Fishing in the Dark”, published December 2022, explains why Planet Tracker, a non-profit financial think tank producing analytics and reports to align capital markets with planetary boundaries, has announced the creation of a Seafood Database.

The 18-page report now available to download from the organization’s website finds that only 8% of the hundred largest seafood companies – both listed and private – disclose the exact seafood species they are invested in for their entire portfolio. This lack of transparency presents a major risk for investors and lenders, preventing an accurate assessment of risk and opportunity. With the objective of promoting greater transparency across the seafood supply chain – and to consolidate different data sources into one place where they can be examined in context – Planet Tracker is launching its Seafood Database.

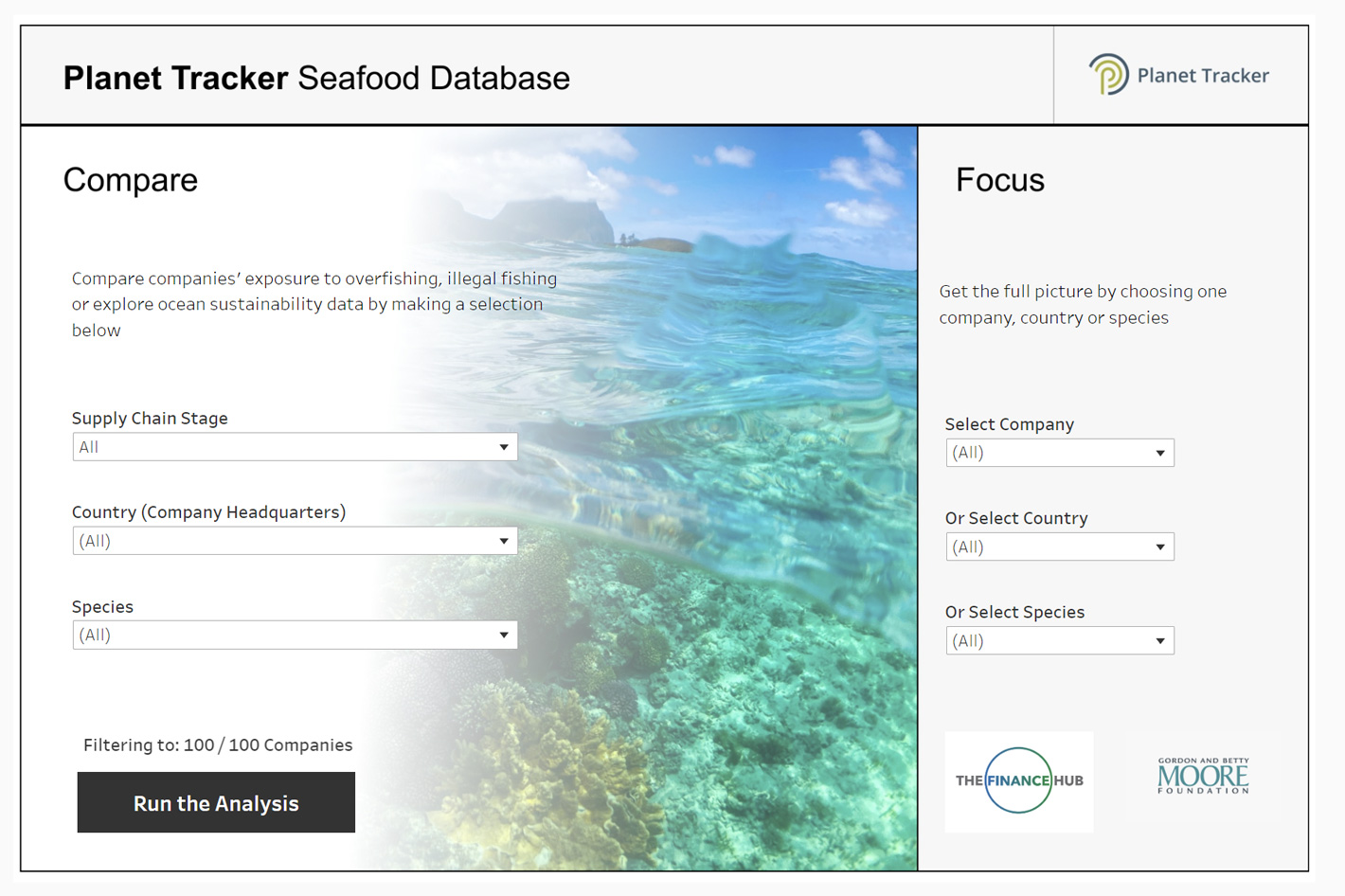

The new and interactive Seafood Database identifies the companies most exposed to overfishing, illegal fishing and other sustainability risks across the $1.8 trillion seafood supply chain and allows users to filter through companies and compare their exposure to the above mentioned risks. The initial sample of 100 corporates have a combination of high revenue – from $200 million to $15 billion – and a high exposure to seafood. In the coming months, more companies will be added.

More transparency from seafood-exposed companies

According to Planet Tracker, these companies are not only engaged in upstream (fishing or aquaculture), midstream (processing), or downstream activities (wholesale, retail), but also in auxiliary activities such as fish vaccination, construction of engines for fishing vessels, or the manufacture of fish processing machinery. On average, each company is engaged in three of these businesses, with processing being the most popular.

François Mosnier, Head of Oceans Programme at Planet Tracker, comments: “Companies that do not have granular data in species exposure and harvesting locations are unlikely to be aligned with the Taskforce on Nature-related Financial Disclosures (TNFD) framework. We estimate that over half of the companies we assessed are not TNFD-ready based on the information they fail to provide.

“The absence of data is often blamed on the suppliers’ inability to provide it and the associated costs of retrieving it, but there are potential financial benefits associated with increased disclosure that companies must not overlook.”

Planet Tracker calls on financial institutions to demand greater supply chain transparency from seafood-exposed companies. This means asking corporates to disclose:

- ‘What’ – the scientific names of the species they are invested in;

- ‘Where’ – the exact location of farming and capture;

- ‘How’ – the fishing gear and farming method used.

Such disclosure can be done via the Ocean Disclosure Project, or directly via the Planet Tracker database, from the Planet Tracker website.

This latest report builds on past research by Planet Tracker into seafood traceability and transparency, including "How to Trace $600 billion, Traceable Returns and Implementing Traceability – Seeing through Excuses."