April 28, 2022

In Atlantic City, optimistic offshore wind advocates acknowledge uncertainty

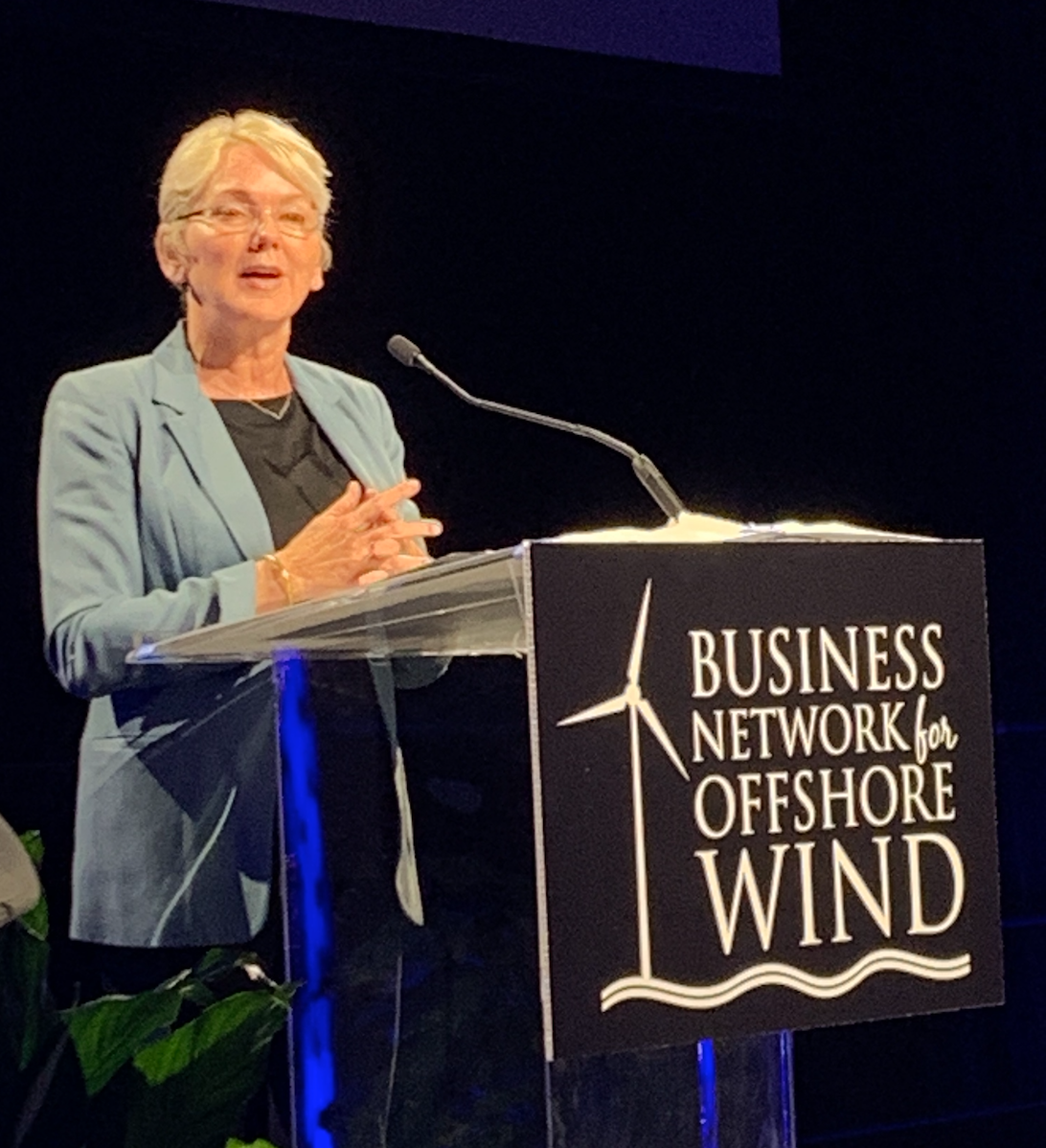

Secretary of Energy Jennifer Granholm said the energy crisis triggered by Russia's attack on Ukraine has put U.S. renewable energy planners "on a war footing." Kirk Moore photo.

You've caught the limit!

Free membership gives you access to:

- Unrestricted access to all NationalFisherman.com articles.

- Receive in-depth reports and research on various topics related to the fishing industry.

- Up-to-date news updates from the fishing industry delivered directly to your inbox twice a week.