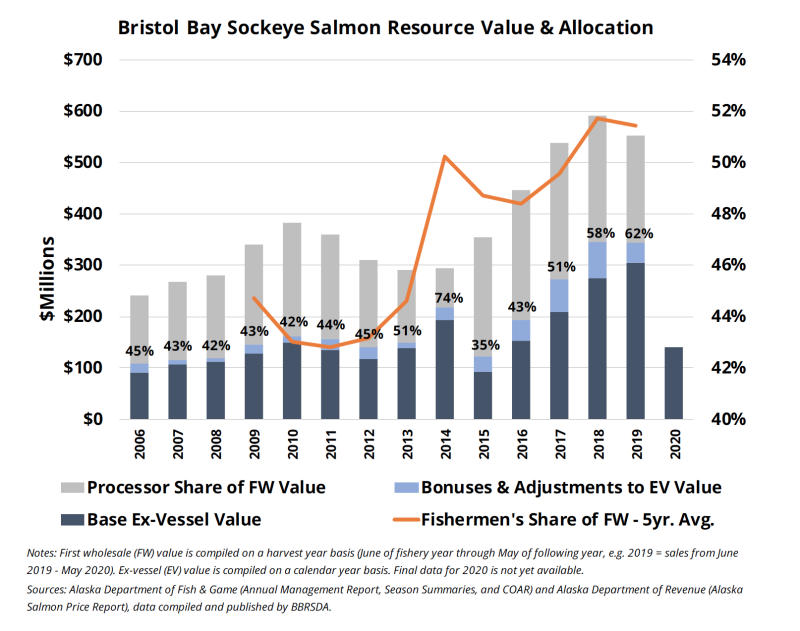

Despite record retail prices and a consistently strong demand, Bristol Bay salmon fishermen saw a nearly 50 percent drop in their base ex-vessel price in 2020 — from $1.35 a pound in 2019 to $0.70 in 2020. That’s a 65-cent drop in a single year.

The Bristol Bay Regional Seafood Development Association published a new report that lays out likely reasons for the low base price. It also offers the region’s fishermen a range of solutions to consider for the future, and is seeking feedback from stakeholders to help set goals for the association.

“Demand for Bristol Bay sockeye is very high. Retail prices are at record levels. Anecdotally, wholesale prices are flat to up compared to last year — significantly so for once-frozen fillets,” says the BBRSDA’s white paper, released Monday, March 1. “When consumer prices are high or increasing for a product, the underlying raw material price usually goes up, not way down. In short, 2020 should have been a terrific season for Bristol Bay fishermen and ex-vessel prices, but it wasn’t (or at least it hasn’t been thus far).”

Though the 2020 season is long over, the vast majority of bay fishermen operate under the “open-ticket” system, according to Andy Wink, executive director of the BBRSDA. That system typically results in an additional payment the following year.

Under the open ticket system, the boat owner/operator communicates with a processor ahead of the season to establish a commitment to deliver or purchase fish, “but no price is committed to,” Wink tells National Fisherman. With each delivery during the season, fishermen receive a fish ticket from the processor, which is a receipt of the delivery and transaction. The price is typically left blank until after base prices are announced — usually at least halfway into the season, according to Wink.

The base price is capped off with a bonus or retro, which is based on processor gains or losses in the market long after the season has closed in July. (The 2020-21 retail year closes at the end of May 2021.)

Though the payout timing on retros varies, “usually they are announced in the spring,” Wink adds.

“As the largest organization representing Bristol Bay fishermen whose mission is to maximize fishery value for the benefit of its members, ex-vessel price is obviously a key concern for the Bristol Bay Regional Seafood Development Association,” the paper says.

“This lower [2020] price equates to loss of $130 million in total ex-vessel value compared to 2019, or roughly $75,000 per driftnet vessel,” the organization reports.

As bay fishermen look ahead to their retro pay for the 2020 season, there’s been a lot of chatter about the processors’ risks — as well as rewards — for a highly successful Bristol Bay sockeye salmon season in an otherwise extremely difficult year.

“Frustration and confusion over the ex-vessel price were common themes in nearly every interaction BBRSDA board and staff members have had with the fleet since last season,” the paper says, “in addition to numerous social media posts and comments.”

A recent BBRSDA survey of fishermen showed that transparency on the part of processors’ reasoning for setting a low base price was the most important issue facing the fleet.

As the association attempts to take next steps in securing fair prices for its fleet in the years to come, it notes in the paper that technically the majority of the region’s processors are under no obligation to do more.

“We've heard that processors deeply value fishermen as key partners and some have expressed a desire to have more transparent communication,” Wink tells NF. “However, there is concern about having too much transparency and public disclosure, and uncertainty about how to be more detailed in their communications without sacrificing privacy.”

And there is still a possibility for a good retro check to come.

“It's certainly possible that fishermen will be paid significant retros ahead of [the 2021] season,” the white paper says. “However, let’s be clear about two things: processing companies are not contractually obligated to 1) pay any more than they have already committed to or 2) share any more information about sales performance than they choose. Even if processors could pay a higher price, there is no contractual requirement to do so without Silver Bay-style profit sharing agreements.”

Processor prices are based on “based on what suits their short and long-term needs best,” the paper says.

And those needs were hard to pin down in 2020.

The BBRSDA notes the primary factors for the low base price:

• Increased business risk and additional operating costs because of covid. As NF has reported, McKinley Research documented an additional $50 million to $60 million price tag on covid-safe operations during the 2020 season. That’s a price processors paid up front.

• Overall, 2020 was not a good year for processors — aside from pollock and bay salmon — and 2019 was also not very good.

• The compressed season led to lower production of higher-value product forms.

The next step, however, is up to fishermen, says the BBRSDA.

“This fishery has a bright future,” the white paper says. “And although it may feel as though the fishermen’s options are limited, you own something truly unique: access to world’s most abundant supply of premium wild salmon.”

• Choice #1 — Accept and continue with the status quo.

• Choice #2 — Negotiate and/or partner with existing processors to:

- Create pricing agreements between fleets and existing processors.

- Create a mechanism for fishermen to earn or purchase an equity stake in existing processors (fractional equity is already an option with Silver Bay Seafoods).

• Choice #3 — Expand, improve or create new channels for market access by:

- Creating a bulk purchasing program for direct marketers.

- Creating a sales and/or logistics company to expand direct marketer capacity.

- Partnering with a new processor offering a pricing agreement.

- Creating a new cooperative processing and sales company.

“While our activities are focused on marketing, quality improvement, and maximizing sustained harvest volume, most of these investments are made with the expectation that fishery value will benefit as a result,” the white paper says.” If there is reason to suspect that fishermen are not reaping rewards from those efforts due to issues involving market structure, we feel compelled to examine the situation collaboratively with our members.”

Members may reach out to BBRSDA via email at board@bbrsda.com or by calling Executive Director Andy Wink at 907-677-2374.

Read the full report or summary at the BBRSDA site.