Russian-caught North Pacific pollock – often laundered through reprocessors in China – continues to flood the world market and needs to be cut off, Alaska’s U.S. senators said in opening the fifth annual summit of Genuine Alaska Pollock Producers.

“I know this meeting comes at a tough time,” Sen. Lisa Murkowski, R-Alaska, said in a video from her Washington, D.C., office as the GAPP conference opened in Seattle, Wash., Sept. 29.

“Prices have dropped as Russia floods the market,” and revenue from pollock helps finance Russia’s war against Ukraine, Murkowski said: “If there was ever a time to call out Russia and ban Russian seafood from entering U.S. markets, the time is now. This has gone on for too long.”

Murkowski and Sen. Dan Sullivan, R-Alaska, are working to raise support in Congress with Rep. Mary Peltola, D-Alaska, and Rep. Garret Graves, R-La., to curtail flows of Russian-caught fish. Responding to a “dramatic decline in prices” demands the U.S. ‘finally close the loopholes and the very unfair practices we’ve had with Russia,” said Sullivan.

The drama has been ongoing since a retaliatory Russian ban after the U.S. imposed sanctions over Russia’s invasion of Ukraine, said Sullivan. Beset by sanctions and trade disruptions because of the covid-19 pandemic, “the Russians started to launder their seafood through China,” he said.

Advocates form the U.S. seafood industry have pushed for action and “it literally took a war to make progress on this,” Sullivan added. Allies have been working with Biden administration, pushing U.S. Customs and Border Patrol and other agencies to close loopholes in trade rules but there remain some divisions in industry and Congress over response the response, he said.

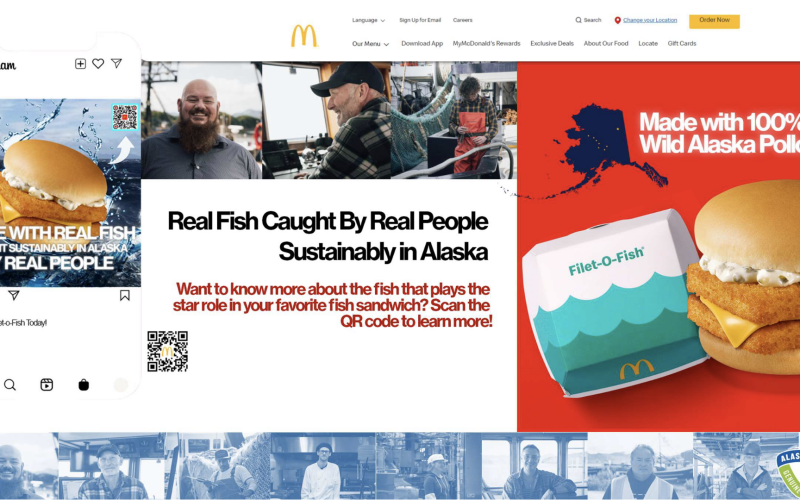

GAPP CEO Craig Morris said “positioning the story of provenance” – telling customers where their fish come from – is a key to success in U.S. and export markets. The group’s promotional campaign now is stressing sourcing, sustainability, and the ‘‘real people” who make the fishery work, he said.

“Provenance is important to consumers. When we asked them what’s important to them in purchasing fish, over half say it’s (being) a product of the U.S. and a third say there motivated to buy knowing it’s a product of Alaska,” said Germaine, chief data and strategy officer at the global communications consultancy Ketchum. “That wild-caught aspect is also very important and has multiple meanings to consumers, all of which benefit wild Alaska pollock. Wild-caught is very much aligned with both sustainability and wild-caught is also aligned with provenance. We’re not only showing our consumers we’re sustainable but also that we’re from the U.S. and driving demand that way.”

That consumer data also indicates strong preference by consumers for fish from the U.S. or Canada “and a notable dislike of fish from Russia and China,” according to a summary released by GAPP. “Specifically, 87 percent of consumers are likely to purchase fish from the United States and data indicates consumers actively try and avoid purchasing fish from China and Russia.”

“We see that when consumers learn their fish is purchased from Russia or China, they’re more likely to feel ‘confused, misled or annoyed,’” added Germaine.

For millennial and multicultural consumers, sustainability “remains key to capturing their hearts and minds,” according to GAPP, with 69 percent of fish-eating consumers surveyed indicate that sustainability remains “very” or “somewhat” important. Consumers are thinking that “sustainability isn’t just about the generic term, but rather the components of sustainability like ocean health and future supply,” the group says.

“We saw an 8-percentage-point increase between 2021 and 2022 in fish eaters saying sustainability is important to their fish purchases,” said Lauren Hasses, Ketchum’s director of analytics. “Sustainability is even more important to millennials; 82 percent say sustainability is important to them when they’re purchasing foods and they’re actively researching it. They are looking into the companies they’re buying from and if they’re not up to par, 15 percent say they are no longer purchasing.”

As the oldest millennials turn 40 this year, Germaine and Hasse also emphasized the need to rethink how we view millennial consumers and incorporate thinking around “parenthood” into marketing and messaging.

“Sixty percent of that millennial audience is a parent, that is significantly higher than the general population. So, thinking about it from that parental mindset is going to be critical to reaching our consumer,” said Germaine.